Over the course of the last year, the global pandemic has shined an unfortunate spotlight on financial insecurities within the American workforce. Many Americans proved to be ill-prepared for unexpected expenses stemming from medical bills and job loss. Reflecting this reality, a survey released in January indicated that only four in 10 Americans had sufficient financial resources to cover a $1,000 emergency expense without needing to borrow the money or use a credit card.

April marks Financial Literacy Month, and as much of the American workforce is trying to get back on their feet post-2020, it’s important to take small steps toward financial empowerment. Below, we share actionable insight and resources to consider implementing over the short and long term.

The importance of emergency savings

Many financial professionals stress having three to six months of funds built up in an emergency account. For some individuals, it can seem daunting to accumulate that much money, but what’s more important is to instill good saving habits. Focus on setting aside money from every paycheck, even if it’s only $10-$20, to deposit into a savings account. Even better, have your employer automatically pull that amount from your paycheck and funnel it into an account so you are not tempted to spend it.

Over time, the accumulation within this account will become a stress reliever — seeing the funds there and knowing that you can take on an unexpected expense will provide a sense of security and strengthen your financial health. Financial Fitness for Life (FF4L) works with a handful of organizations that provide education on establishing emergency funding strategies.

Setting a budget

One of the most important pillars of financial security is the ability to set and stick to a budget. Having a budget allows individuals to understand their spending habits and saving abilities, as well as how to remedy any “financial holes” that might be contributing to poor planning.

Each month, sit down and carefully review spending and saving patterns. Add up all fixed expenses (housing, car payments, utility bills, etc.) and then determine what you are comfortable allotting toward discretionary expenses (such as entertainment). Finally, there should be enough left over to devote toward savings. Each month, rinse and repeat until you have formed strong financial budgeting habits.

Debt management 101

Before you can properly tackle debt and feel empowered to have it under control, you need to take a step back and understand that debt. Recognize the difference between good debt and bad debt, what interest rates are and how they impact you, how a credit score affects you, what you need to be paying off each month, etc.

Pass the torch

Many Americans are stuck in an unfortunate cycle when it comes to financial literacy. Few of us are taught money basics in elementary, middle or high school, so we are essentially left to “figure it out” when we reach adulthood. This situation is then exacerbated because the same adults who weren’t taught money basics growing up often don’t teach younger generations about them either.

While that circumstance represents a different blog post to tackle on another day, it is critical for this “transfer of knowledge” to occur. Teach children about your interactions with money. Better yet, show them how to write a check and work on a monthly budget. Talk to them about how much you are putting away in savings.

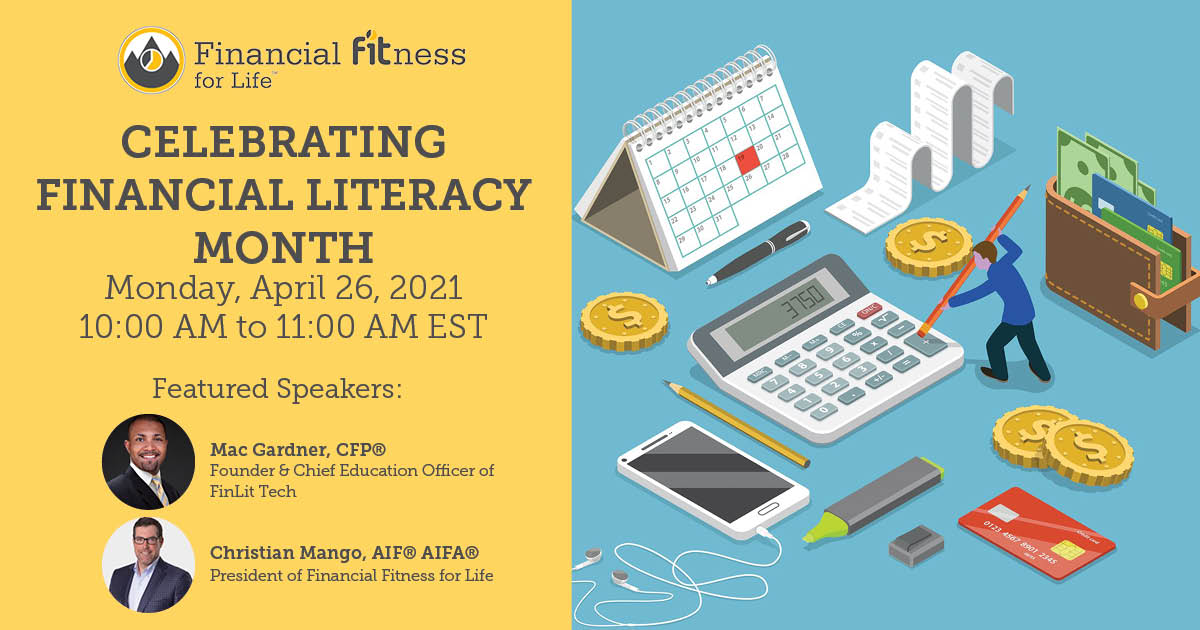

By passing values to children early on, we can empower a younger generation with stronger money skills. Later this month, FF4L will host a webinar featuring an interview with Mac Gardner, CFP®, a proponent of childhood financial literacy who is the author of the book, “The Four Money Bears.” During FIT4Learning Webinar, we’ll chat about how parents can introduce and discuss financial literacy concepts with their kids. Details are below – click here to register!

Aside from educating yourself on financial literacy, I would also recommend turning to your employer to see if they can assist. For example, FF4L partners with many workplaces across America to provide financial education and wellness resources for their employees.

It’s in everyone’s best interest to be financially literate. Following a most stressful year, individuals should shine that spotlight on their finances and work toward small, attainable goals that will create a more secure financial future.

Advisory services offered through Fiduciary Investment Trusts, LLC, a Registered Investment Adviser. Fiduciary Investment Trusts, LLC: 6201 College Blvd., 7th Floor, Overland Park, KS 66211. Fiduciary Investment Trusts, LLC doing business as Financial Fitness For Life. Fiduciary Investment Trust (including Core Series) Funds are organized as collective investment trusts and Comerica Bank & Trust, National Association (“Comerica”) serves as the Funds’ trustee and administrator.